carried interest tax reform

The case for providing capital gains relief for. For instance the plan reduces taxes on all businesses by 42 percent resulting in a 20 percent tax rate for.

How Do Taxes Affect Income Inequality Tax Policy Center

House Committee on Ways and Means.

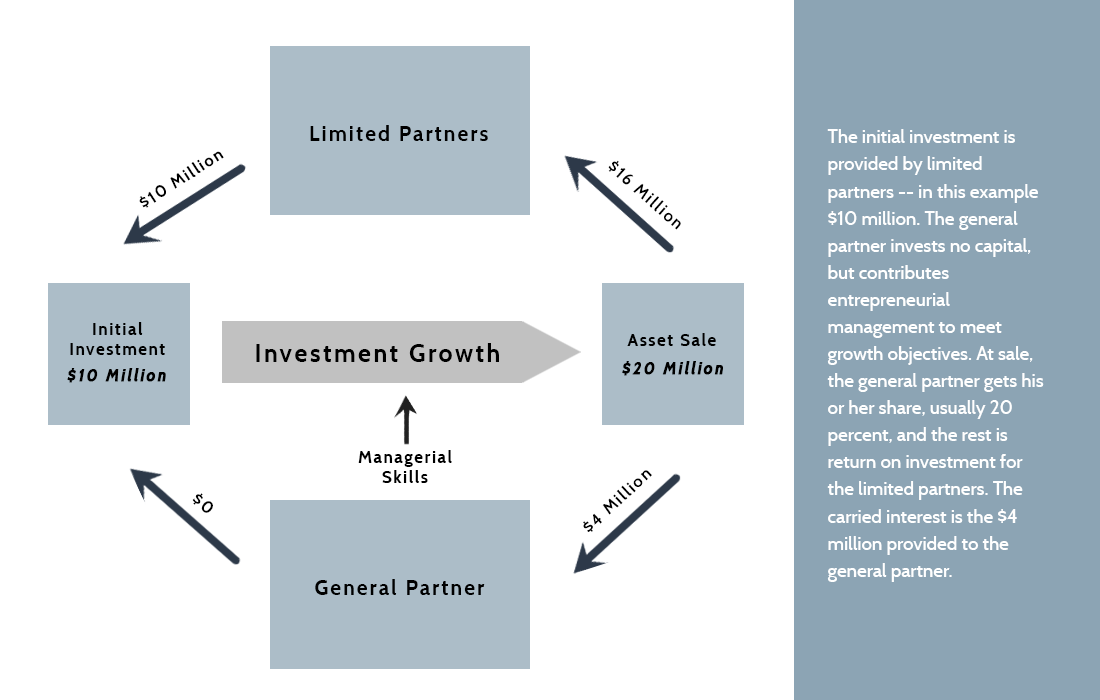

. The Republican tax reform framework contains numerous provisions which will increase economic growth raise wages and create new or better jobs for American families. Result of these interactions is that carried interest is generally taxed as a capital gain or qualified dividend often at a rate of 20. Carried interest reform will almost certainly be part of any major tax reform bill offered by Camp or Baucus.

Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street. The grant of a carried interest without liquidation value would continue to be tax-free but holders would need to take into account a three-year holding period to obtain the preferential tax rate. Following the enactment of the 2017 Tax Reform practitioners considered the ability to use carry waivers as a possible technique to avoid the implications of Section 1061 and often incorporated such.

Eugene Steuerle gave testimony on the taxation of carried interest before the US. With ongoing negotiations among democrats regarding key provisions in president joe bidens build back better agenda that would increase taxes on wealthy individuals investors and corporations. Democrats have proposed raising taxing carried interest capital gains.

This 20 rate for carried interest is the top rate applicable to long-term capital gains which applies to carried interest if. Raising taxes on carried interest capital gains will eliminate 49 million jobs and cause pension funds to lose 3 billion per year according to a new study by the US. He notes among his findings that as a matter of both efficiency and equity capital gains relief is best targeted where tax rates are high as in the case of the double taxation of corporate income.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax.

But its also possible that even if tax reform efforts fail or stall carried interest legislation could find its way into an extenders package or as a pay-for for deficit reduction or an extension of the debt limit. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers. All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment.

NMHCNAA believe that carried interest should be treated as a long-term capital gain if the underlying asset is held for at least one year. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary income tax rates of up to 37 percent that. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried interest to current inclusions of compensation income taxable at ordinary income rates in amounts that purport to approximate the value of a deemed interest-free loan from the.

But closing the so-called carried interest loophole by taxing private equity profits at personal income rates instead of at lower capital gains rates is. The industry strongly opposed extending the holding period to three years as part of tax reform legislation enacted in 2017 but notes that final regulations released in January 2021 exclude Section 1231 gains from the. Chamber of Commerces Center for Capital Markets Competitiveness.

Carried interest was supposed to be addressed in 2017s tax-reform law but the realities of what didnt change are starting to sink in now. A proposed change to tax laws for partnerships has drawn stiff opposition from two advocacy organizations for builders. Carried Interest Reform Under the Bill the concept of an applicable partnership interest API would be introduced in the Code which is generally intended to capture the profits interest aka carried interest held by the sponsors of private equity hedge venture capital and other investment funds that are structured as flow-through entities.

Carried Interest Is A Capital Gain And Should Be Maintained As Such. Some view this tax preference as an unfair market-distorting loophole. Carried interest allows hedge funds to evade their tax obligations.

Congress has proposed to more than double the income tax on carried interestthe payout that fund managers receive when their investments are profitableto prevent fund managers from receiving a purported windfall3tax scholars and politicians have cited the preferential tax treatment of carried interest as a significant legal loophole because. Carried Interest and Other Tax Reform Highlights for Investment Funds and Asset Managers by Patrick B. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

Williams Olivier De Moor Alexander Specht Investment Adviser and Fund Compliance Investment Management Labor Private Equity Tax. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains. 1068 otherwise known as the Carried Interest Fairness Act of 2021 would boost taxes on real estate by requiring carried interest to be classified and taxed as ordinary income rather than as a capital gain.

Carried interest reform is a sham - The Washington Post Republican lawmakers carried interest reform doesnt require proceeds from profits interests to be treated as ordinary income which. The carried interest tax is a direct attack on the structure of partnerships that are used by innovative businessesfrom small firms to venture capital and angel investors that take risks and make an outsized contribution to economic growth and job creation. Carried Interest Waivers.

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Biden Businesses Tax Collections Would Be Highest In 40 Plus Years

Opinion Money For Property Tax Reform Is There For The Asking

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Pin By Gst Suvidha Centre On Gst Online Accounting Software Accounting Accounting Services

What Are The Consequences Of The New Us International Tax System Tax Policy Center

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Angels Angered As Lobbyists Shape Biden S Tax Reforms Financial Times

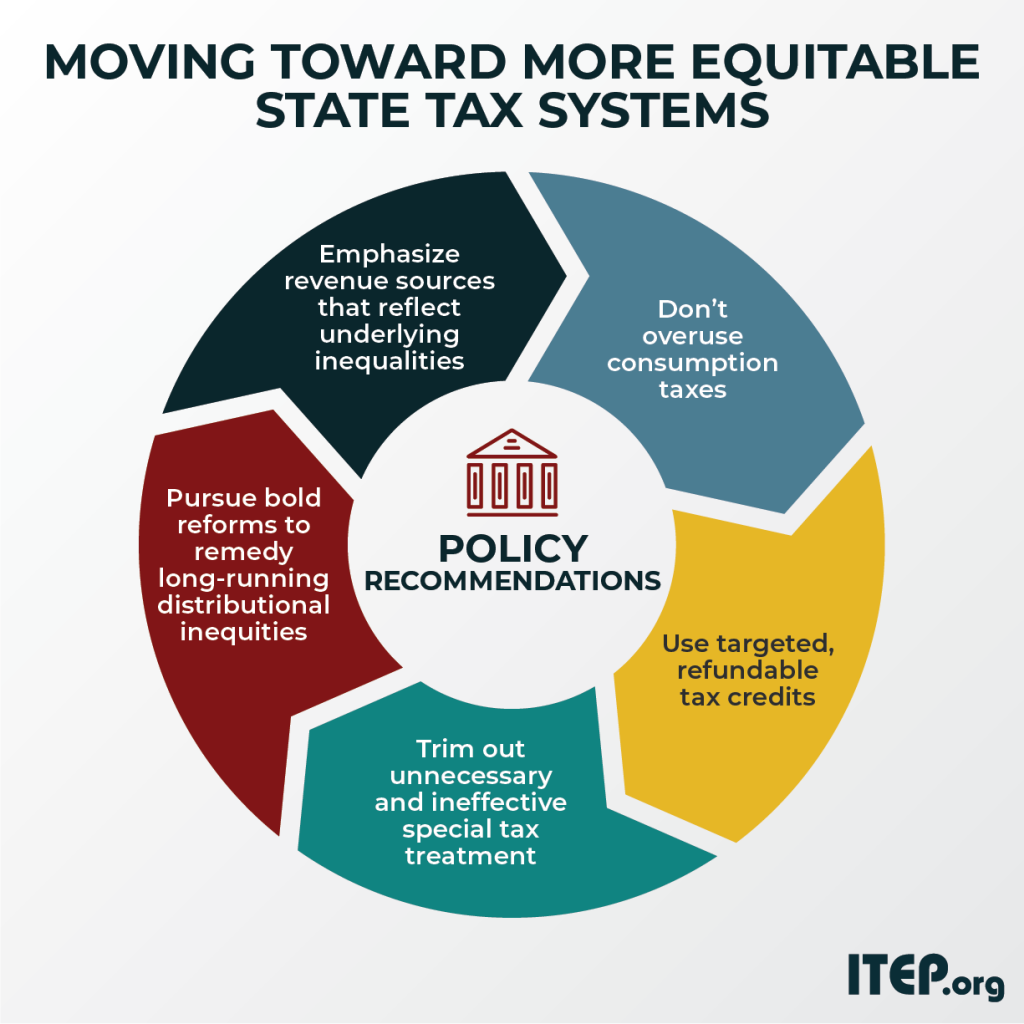

Moving Toward More Equitable State Tax Systems Itep

Remote Work Tax Reform Improving Tax Mobility And Tax Modernization

How Do Taxes Affect Income Inequality Tax Policy Center

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

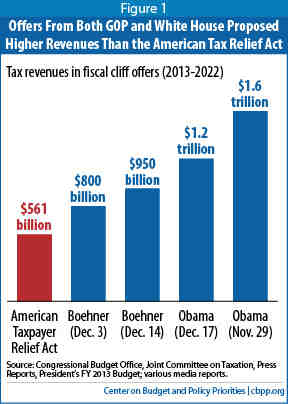

Tax Expenditure Reform An Essential Ingredient Of Needed Deficit Reduction Center On Budget And Policy Priorities

The Tax Treatment Of Carried Interest Aaf

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)